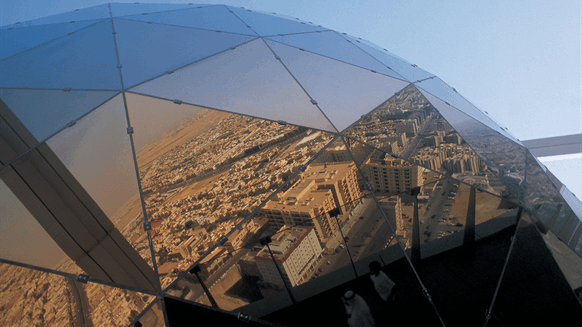

Saudi Crude Oil Exports Plummet

Saudi Arabia’s crude exports fell sharply in August as the kingdom leads an effort by the OPEC+ alliance to curb production and bolster oil prices.

Observed flows from the kingdom slumped to about 5.6 million barrels a day, the lowest since March 2021, data compiled by Bloomberg show. That compares with a revised 6.3 million barrels a day in July. Shipments to most major destinations, including China and the US, plummeted to multiyear lows.

The Organization of Petroleum Exporting Countries and allies including Russia are restricting supply in order to buttress the market, particularly amid signs of lackluster demand in major oil consumer China. Since July, Saudi Arabia has pledged to implement a unilateral production cut of 1 million barrels a day on top of existing curbs.

Saudi officials didn’t immediately respond to a request for comment on August’s oil exports. Friday is the start of the weekend in the country. The figures compiled by Bloomberg, which are preliminary, are broadly in line with those from analytics firms Vortexa Ltd. and Kpler.

Flows to China, the kingdom’s primary market, slumped to about 1.3 million barrels a day. That’s the lowest observed since June 2020, in the early months of the pandemic, when oil demand plummeted globally. Saudi exports to Japan and South Korea in August fell to the lowest levels since Bloomberg began tracking them in 2017.

Shipments westward also plunged. Observed cargoes to the US were just 81,000 barrels a day, the smallest volume observed in a least six years.

However, that may change as vessels hauling roughly 24 million barrels of Saudi crude that loaded last month still haven’t signaled a final destination. That means the numbers for specific countries — particularly long-haul shipments — are likely to rise in the coming weeks.

Saudi Arabia wasn’t the only Middle Eastern energy giant to curb flows in August. Shipments from Kuwait — OPEC’s fifth-largest producer — fell to about 1.5 million barrels a day, the lowest since at least late 2016. Shipments to China, the biggest buyer of Kuwaiti barrels, plunged by about 45%.

--With assistance from John Deane, Grant Smith, Prejula Prem and Julian Lee.

WHAT DO YOU THINK?

Generated by readers, the comments included herein do not reflect the views and opinions of Rigzone. All comments are subject to editorial review. Off-topic, inappropriate or insulting comments will be removed.

- OPEC Fund Chips In for $200MM Financing for Egypt Food Security

- Chevron Australia, Striking Workers Agree to Terms Proposed by Tribunal

- UK Offshore Wind Industry Risks Cancellations: Hedge Fund Chief

- Analysts Examine USA Gas Inventory

- BP, Pertamina Eye CCUS, Blue Ammonia Projects in Indonesia

- Vietnam Upstream Sector Outlook Brightening

- Union Jack Acquires Interest in German Assets Through Beacon

- California Sues Big Oil Demanding Damages, Relief

- Oil Drops as Fed Signals Further Rate Hikes

- North America Breaks Rig Loss Streak

- Who Produced the Most Natural Gas in 2022?

- Cocaine Is Set to Overtake Oil to Become Colombia's Main Export

- Brent Oil Price Highly Likely to Move Above $100

- EIA Bumps Up USA Diesel Price Forecast

- Aramco, ExxonMobil Chiefs Insist Oil Needed in Energy Transition

- Shell, BP, Eni Accept Licenses for First Ever UK Carbon Storage Round

- Gazprom Delivers LNG to China via Arctic Route for First Time

- Saudi Crude Oil Exports Plummet

- What Would Happen to the Oil Price If OPEC+ Went into Max Production Mode?

- Oil Market is Bewildered

- Market Expert Says $100 Oil Is in Sight

- Big Tech Is Coming for Oil Patch Workers

- BMI Reveals Latest Brent Oil Price Forecasts

- For Global Oil Markets, a USA-Iran Deal Is Already Happening

- Saudi-Russia Move Can Only Result in One Thing

- BP CEO Resigns amid Probe into Relationships with Colleagues

- California Sues Big Oil Demanding Damages, Relief